When discussing direct labor, price is referred to as rate, and quantity is referred to as efficiency. Variances between the standard and actual amounts are caused by a difference in efficiency or rate. The total direct labor variance is separated into the direct labor efficiency and direct labor rate variances. As shown in Exbibit 8-1, Brad projects that the standard variable cost to make one unit of product is $7.35.

- For example, material variances can come as a result of a difference in material quality used.

- Similarly, companies can further divide these variances into several levels for a better understanding of the differences.

- Examples of indirect labor include wages paid to the production supervisor or quality control team.

- Once you’ve decided what you want to measure, calculate the difference between your prediction and actual results.

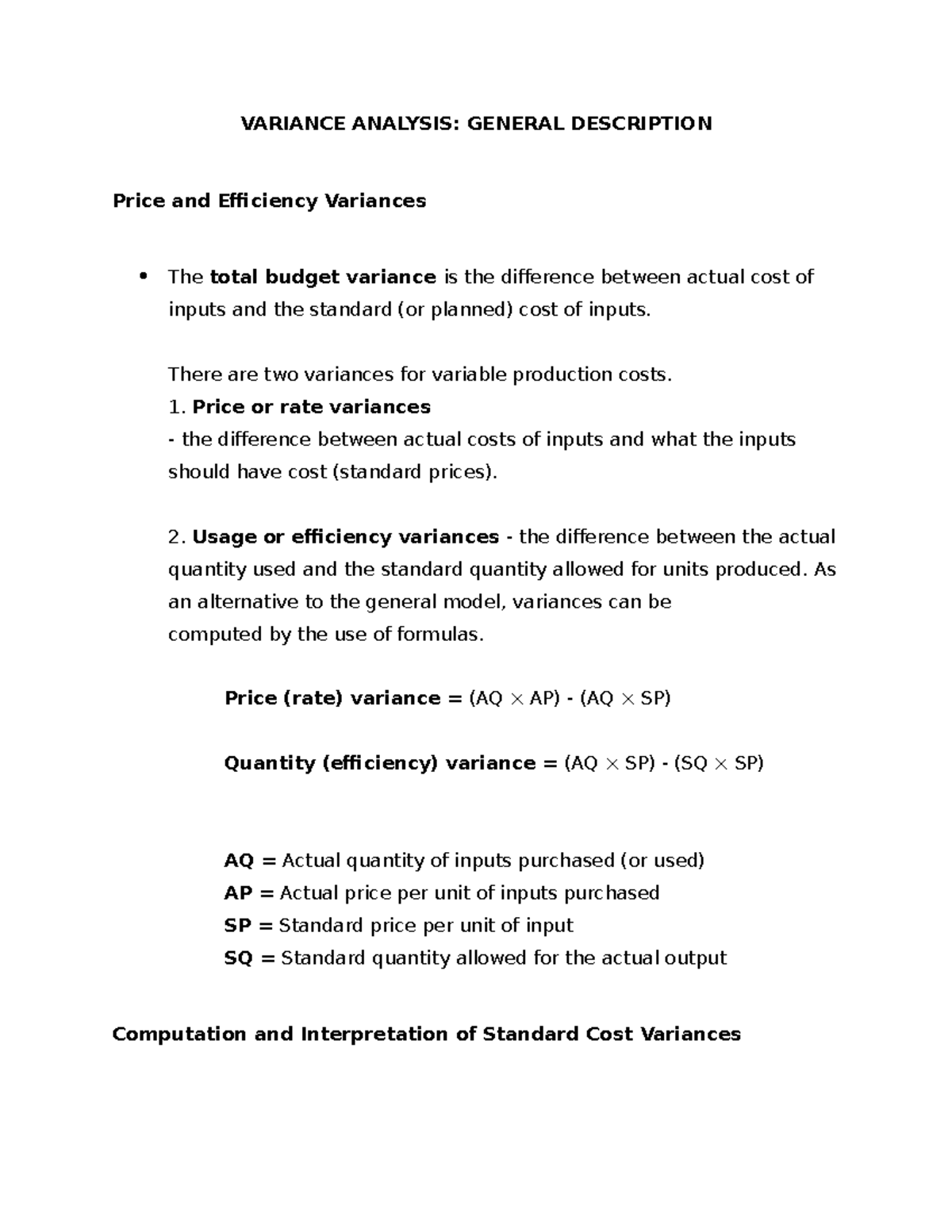

Total direct material variance

The actual expenses incurred during production may differ due to several reasons. These include wastage, unforeseeable circumstances, inefficiencies, unrealistic standards, etc. However, companies must pinpoint the reason for any variance from standard costing. In accounting, the difference between the standard or projected cost of items and the actual cost paid for such materials is referred to as the purchase price variance.

Direct labor efficiency variance

Therefore, there is an element of uncertainty that may cause standards to vary from actual results. Operational factors may come from wastages, inefficient processes, etc. Usually, the higher the size of variance is, the more critical it gets. However, there is no set standard for how much the size should be before a company investigates it. Usually, the size will differ according to the company’s requirements. Companies may use a variable percentage or fixed rate to set a benchmark for variances that they should investigate.

Ethical Long-Term Decisions in Variance Analysis

The actual price of $0.55 per unit is not given in the actual data presented in Exhibit 8-1. However, it can be calculated by taking the total purchase price and dividing it by the total number of feet purchased. The example of the NoTuggins dog harness is used throughout this chapter to illustrate standard costs and standard costs variances for product costs. Brad invented NoTuggins, a revolutionary dog harness that stops dogs from pulling when connected to a leash by humanely redistributing the dog’s pulling force. NoTuggins was featured as the most innovative new harness by the International Kennel Association. Brad sold 150,000 units of NoTuggins during the first year of operations.

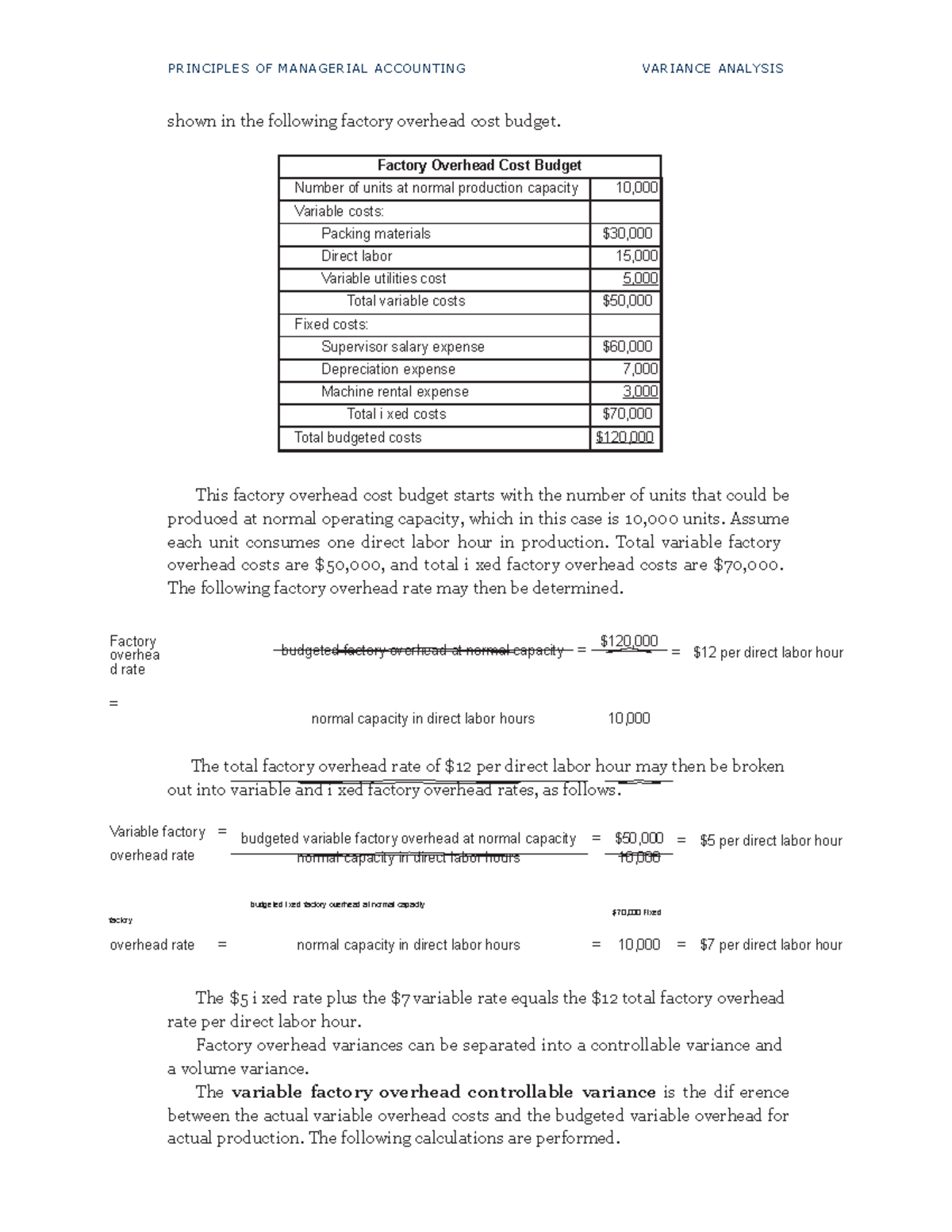

Actual manufacturing data are collected after the period under consideration is finished. Actual data includes the exact number of units produced during the period and the actual costs incurred. The actual costs and quantities incurred for direct materials, direct labor, and variable manufacturing overhead are reported in Exhibit 8-1. Variance analysis should also be performed to evaluate spending and utilization for factory overhead. Overhead variances are a bit more challenging to calculate and evaluate. As a result, the techniques for factory overhead evaluation vary considerably from company to company.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Finance Strategists has an advertising relationship with some of the companies how to invoice as a freelance designer included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Variance analysis helps managers focus on possible causes of problems and improve performance.

Variances are favorable if the standard amount is more than the actual amount. When using the template format presented in this chapter, positive variances are favorable and negative variances are unfavorable. In the NoTuggins example, the total standard direct materials allowed was 630,000 feet. However, they were able to produce the 150,000 units using less material, which is favorable. If the actual amount exceeds the standard amount, the variance is unfavorable (U) indicating they used or paid more than the standard amount, which is unfavorable. The total variable overhead cost variance is also found by combining the variable overhead rate variance and the variable overhead efficiency variance.

The variable manufacturing overhead variances for NoTuggins are presented in Exhibit 8-10 below. This approach to calculating variances facilitates comparison of like with like. Hence, we can compare the actual expenditure incurred during a period with the standard expenditure that ‘should have been incurred’ for the level of actual production. Similarly, actual sales revenue can be compared with the standard revenue that ‘should have been earned’ for the level of actual sales during a period in order to determine the effect of variance in prices. In conclusion, variance analysis helps businesses stay on track financially. By dissecting material, labor, overhead, sales, and profit variances, organizations gain invaluable insights into their financial health.